Markets end up in limbo while waiting for any major catalyst to propel them further. The FED keeps reiterating ”higher for longer” while the rates markets begin pricing in rate cuts all while the demand for the FED ”hidden QE” in terms of their discounted borrowing program soars showing a healthy new level of willingness to take on risk in the markets. However BTC is still knocking on the 30k door, and the Penalyst is here to tell you why we might not have broken through yet.

I’ve said before that the US tech stock and BTC correlation has been off now for some while, and this was all so clear last week as the NASDAQ went on a decent bull run, while BTC moved more or less sideways.

The soaring demand for the FEDs discounted borrowing program suggests the financial markets are willing to take on risk again, but why didn’t this show in the digital asset space?

Well, for one we got the news of US regulators going after Binance. Some would argue that if there ever was a ”to-big-to-fail” entity in crypto, Binance would be just that so this news was not taken well by the market. Additionally, the focus on crypto investment naturally shifted for several Binance investors, especially larger whales, and institutions to diversify exchange risk exposure by instead moving funds to other exchanges until further clarity has been brought to the situation. A thesis supported by several on-chain data metrics too.

Adding to that, the US government announced that they were going to sell a rather large amount of Bitcoin confiscated from the Silk Road shutdown in increments over the next months, acting as almost a sort of involuntary temporary QE of the price of Bitcoins.

I've talked about this before, the need for supply coming into the market meeting enough demand to be swallowed up for a true new bull cycle of the digital asset space to take place. And although we can eventually get there, the news of supplying such a high amount of BTC into the market does not have the demand to meet it at this point. However, this type of market dynamic should really just be seen as a short-term discount for the long-term investor.

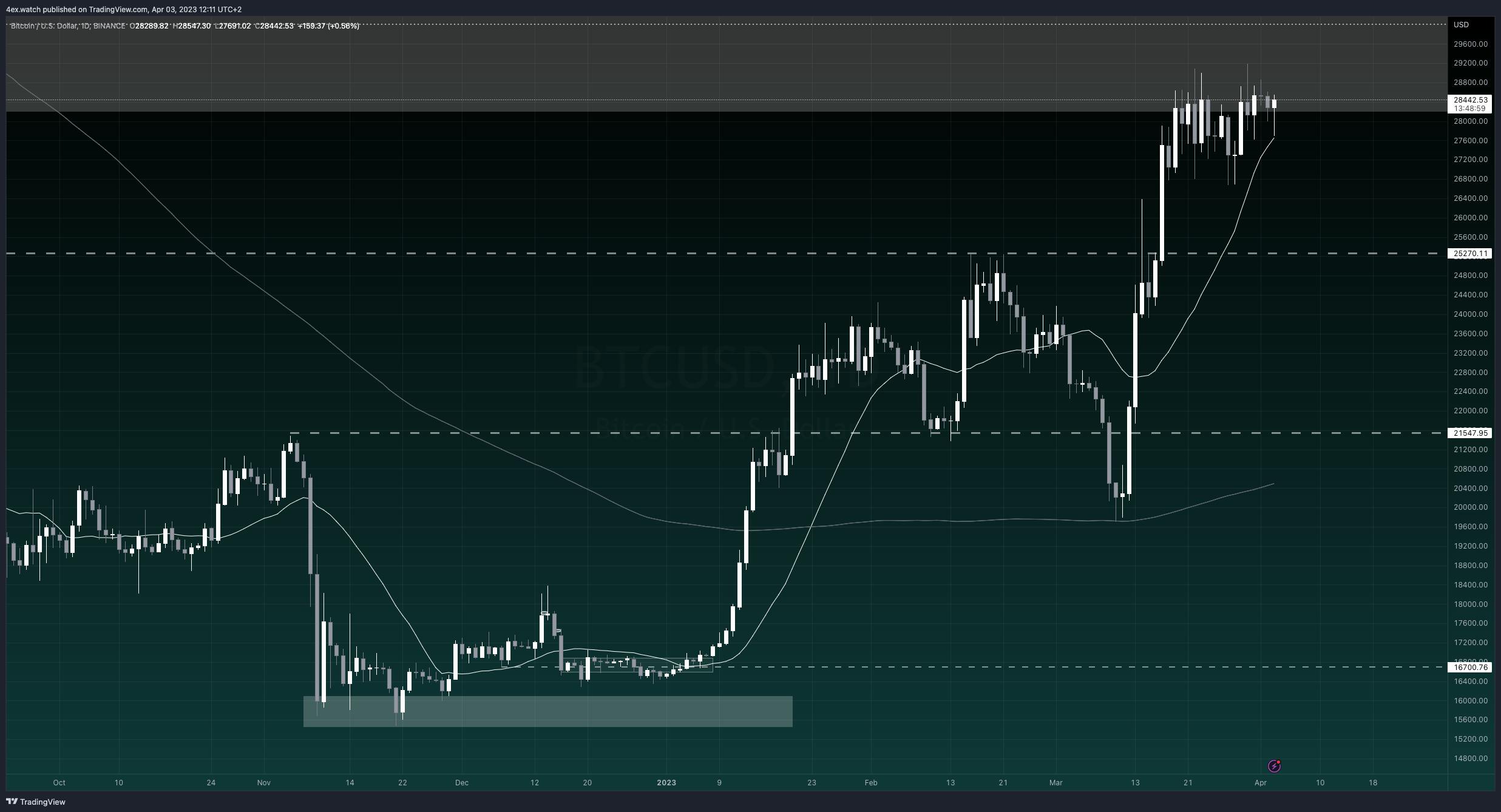

BITCOIN (USDC)

There isn’t much to say on the charts this week. Bitcoin remains at the border of the previously highlighted liquidity level, still, supported by both long and short-term moving averages suggesting there is a higher likelihood of the price pushing higher than lower.

Levels remain the same, and I still expect a visit of 30-32k before any larger pullback. With a new quarter taking off, will we see some larger inflows into the mother of all digital currencies as institutions position for the coming 3 months under the newly formed ”risk on” sentiment?

US DOLLAR INDEX

The US dollar continues taking blows to both the body and the head, fairing somewhat well considering how it’s getting pummeled against the ropes recently.

Back in 1971, US President Nixon removed the gold standard, letting the value of the greenback flow freely for a couple of years, before 1974 when the US and Saudi Arabia struck a deal determining all oil transactions to be settled in US dollars. As such, the US dollar gained a new unofficial standard, the oil standard, which cemented the US dollar as the world's reserve currency. Until now.

Last week several market participants, including Saudi Arabia, Brazil, Russia, and China were rumored to leave the greenback behind them and start settling trade in other currencies. Although we yet have to see this layout, and the effects wouldn’t be fully felt until several years down the line, it would suggest the future value of the dollar would be more connected to the US economy rather than anything else, and with current fundamentals of the US, the greenback to further hits from this potential scenario.

From a price perspective, levels remain the same and the index is still weighted by both moving averages, suggesting further downside.

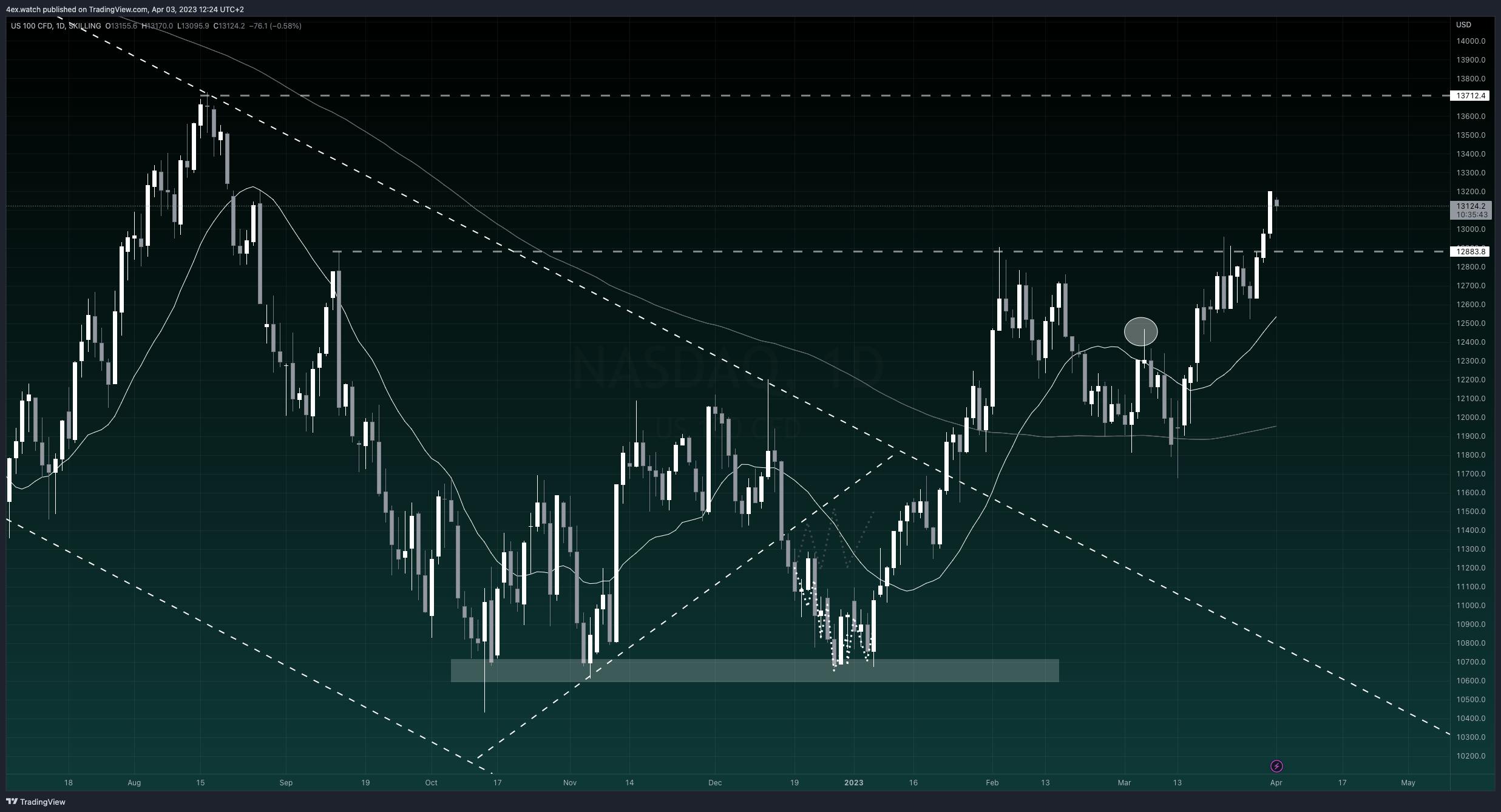

NASDAQ100

I highlighted the potential for the NASDAQ to move higher last week as an effect of quarter-end flows, and we saw just that. The index managed to break through the moderate resistance of the previous triple top and move higher, putting 13712 on the map.

But smooth sailing up there really requires no worrying data to hit, nor any negative news headlines coming out and although it is possible, it’s not too convincing in these markets.

I’m expecting some chop for now.

CLOSING COMMENTS

The market is entering the new quarter with positivity but caution and we await a larger market catalyst to get things moving again.

- The Penalyst