The FEDs “higher-for-longer” mentality hits the US banking sector and the largest banking crash since 2008 is in full effect. Effects spill over into the world of digital assets crushing USDc and showing the immense vulnerability of traditional stablecoins. Meanwhile, digital assets re-gain ground into the new week and The Penalyst is here to give you his take on the situation.

There’s blood in the waters, and while most swim for the shore, the sharks of Pennings alternative investment fund are instead circling the waters as they smell opportunity.

So over the last couple of weeks, I’ve been calling for caution as well as highlighting the expected volatility and risk coming into the markets at the end of March and the beginning of April. And boy oh boy was the timing of such cautions on point.

The FED has a tendency to keep poking the market until something breaks, whether it be through immense quantitative easing or through vicious hiking cycles. And one could very well argue that the FED just broke something with the US banking sector taking a massive hit. The market is now pricing a 74% chance of “only” a 25bps rate hike in march, and all major investment banks changing their outlook to very uncertain.

We still have the risk of inflation, so what exactly the FED will do, we do not know. However, one thing we can be sure of is that they will have to make changes to their approach going forward.

This combined with the FED issuing a “hidden” QE plan going into effect in the near future, there are some positive headwinds for digital assets too.

The market is still in a transitional period, but for the long-term investor not to fuss with short-term noise, this is the time to start deploying your plan.

BITCOIN (BTCUSD)

BTC is starting the week regaining ground after some rather violent sell-off into the weekend. This is as news breaks of depositors being bailed out by the US government in failing banks, but also Binance moving over 1 billion worth of originally stablecoin nominated funds into spot crypto.

BTC continues to trade with clear levels already highlighted from before, with the 200-day moving average remaining our line in the sand for a structural shift into a prolonged bear market.

To the upside, the 30k liquidity zone remains the target for now.

On-chain we can see that volumes are picking up slightly but in a good way where it seems investors are picking up coins at a discount and looking to hold these rather than offloading them at any sign of profit.

Additionally, looking at BTC’s realized profit and loss ratio (RPNL) the structure is similar to what we saw in 2018 and 2015, where we have just regained positive values again, and this typically signals the beginning of a longer-term uptrend. However this comes with a couple of successive dips to the trend in the beginning, and these can be rather large, as offloading of the profits become too great for the market demand to soak up initially.

US DOLLAR INDEX

The US dollar is rejecting nicely previously highlighted resistance and is currently holding onto minor support. However the short-term moving average has been lost, so for now the dollar is signaling further downside.

We do however have a very data-heavy week, and we are not past the previously mentioned three weeks of volatility and structural changes to market direction, so do proceed with caution.

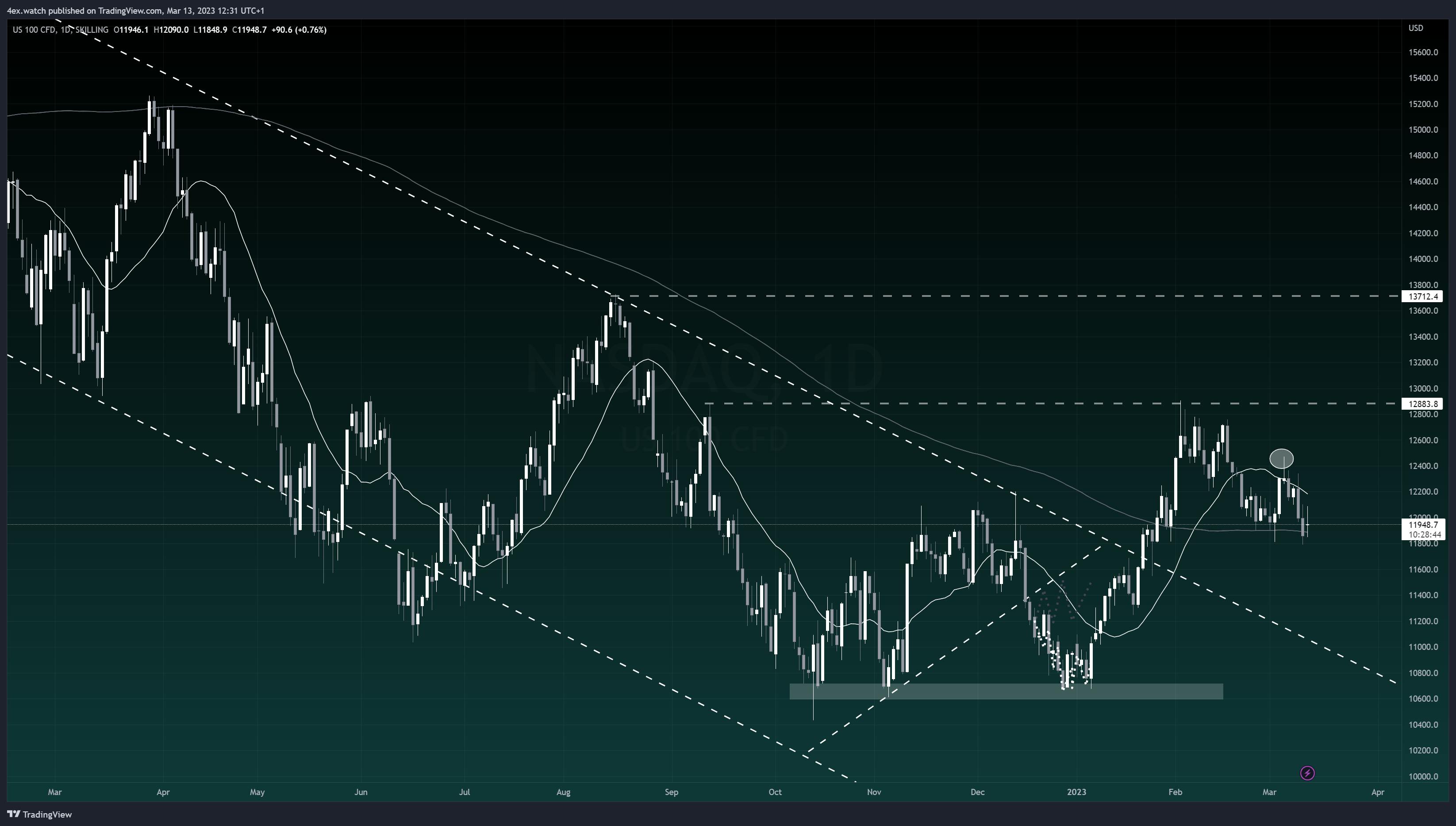

NASDAQ100

The Nasdaq hit right into my projected liquidity area of 12470 before reversing lower, and naturally taking a hit here from the banking failures in the US. But as mentioned in previous reports, the Nasdaq – BTC correlation is and has been, off now for some time so I use this more as a risk sentiment indicator right now rather than the normal correlation.

CLOSING COMMENTS

So to round off, there are some signs of sunlight between the clouds on the stormy sky that is the digital asset market right now. We just need to navigate these next couple of weeks for a better understanding of what the direction will be in H1 of 2023. Expect a data-heavy week with further volatility and violent price action, so proceed with this in mind.

-- The Penalyst