The world of digital assets continues to fly higher, all whilst the market is playing chicken with the FED on policy and further rate hikes. Meanwhile, it looks like the eurozone will be able to avoid an outright recession and general sentiment is widely approving everywhere. Almost everywhere.

The team at Penning is not yet convinced about the recent developments and here is a cause for concern when such a large portion of the market decided to cling to a narrative that is not that cemented in the underlying fundamentals and global picture.

We still have a war raging in the middle of Europe with Russia coming under more and more pressure. And over in the states as well as for the eurozone all we need to see is an uptick in inflation again to see markets become more nervous than a Lehman trader holding a subprime portfolio in 2008.

We are not out of the woods yet.

We are in a tricky spot however The Penalyst has some views on how to navigate this future landscape. Usually, one would look at technical analysis and pair it with fundamental analysis. However, the world of crypto and DeFi is still so young, that it hasn’t actually experienced for example a rate environment >2.5%.

There used to be this broad narrative for the digital asset space that it was NOT correlated to macroeconomics and that the correlation to US stock indices is something that has grown over the last few years. Well, although the latter might be somewhat true, the first statement surely isn’t. The problem was that crypto and DeFi came up in a zero-rate environment with global markets, liquidity, and risk in “easy mode”. The correlation was there, it was just taken for granted and therefore missed.

As we now move into a higher-rate environment with tighter liquidity conditions, it becomes uncharted territory for this young asset class and how it will perform.

Therefore, my take on it is to focus less on fundamental analysis for the asset class and more on the unique, rather freshly formed and established analysis of so-called on-chain analysis. And that is showing some very interesting developments…

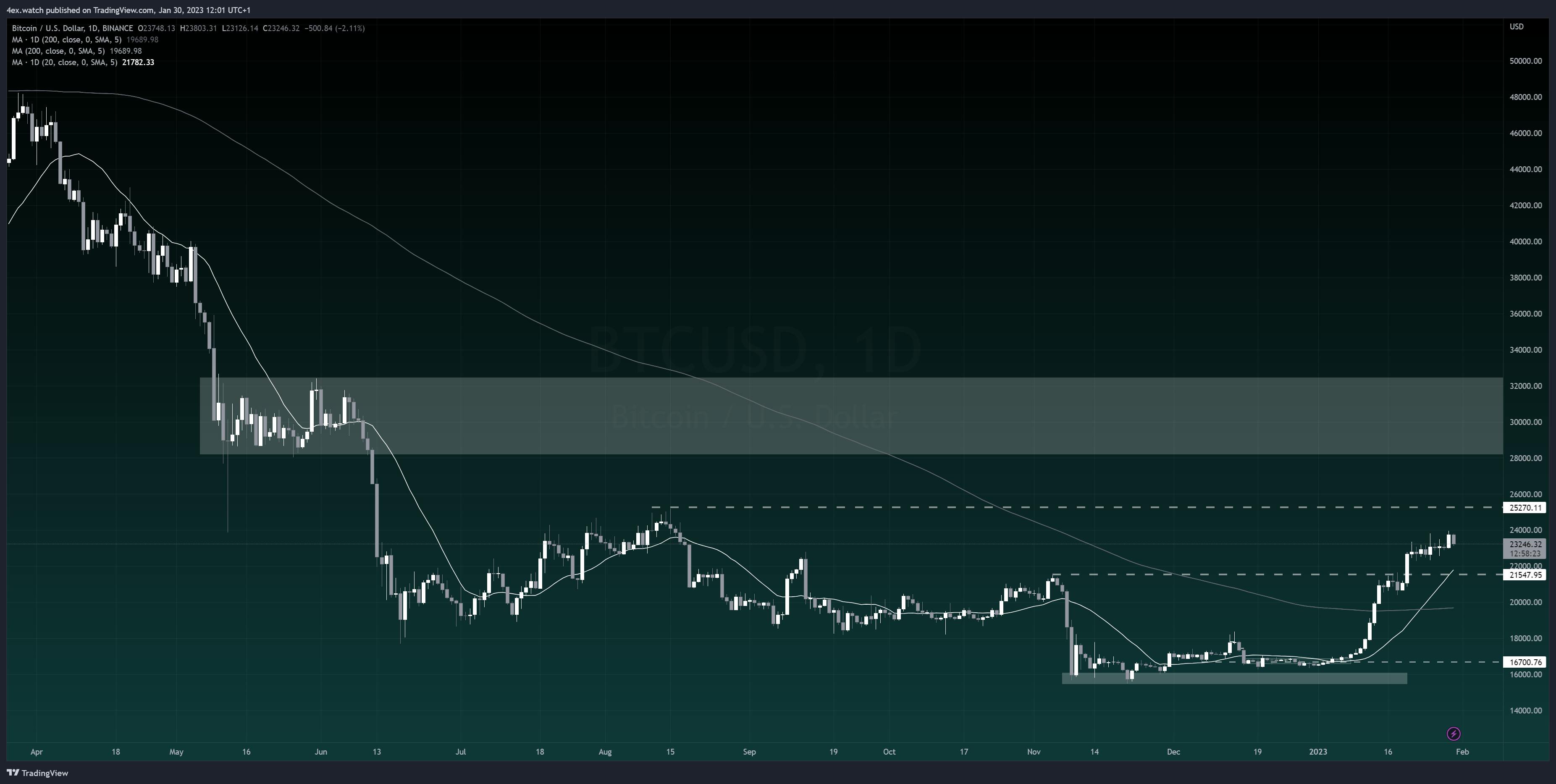

BITCOIN (BTCUSD)

BTC on-chain data shows that short-term investors are liquidating and realizing gains with more than 92% of short-term holders in overall profits as BTC taps the 24 000 level before retracing. The same goes for miners taking exit liquidity however long-term investors are becoming increasingly positive with 6-month supply reaching new all-time highs.

So long term the market is starting to build a healthy base, and although risks remain elevated for the continuing of the year of another leg down, on a broader scale there is no doubt a bottom in the crypto market is forming, the question is if there is enough liquidity around right for it to be in place already. Time will tell.

On the technical side, not much to say that hasn’t already been said. Previously highlighted levels hold and remain in play and we got a large batch of data coming this week that will move the markets. As such, seeing short-term profit taking, especially into Wednesday's FOMC meeting is expected.

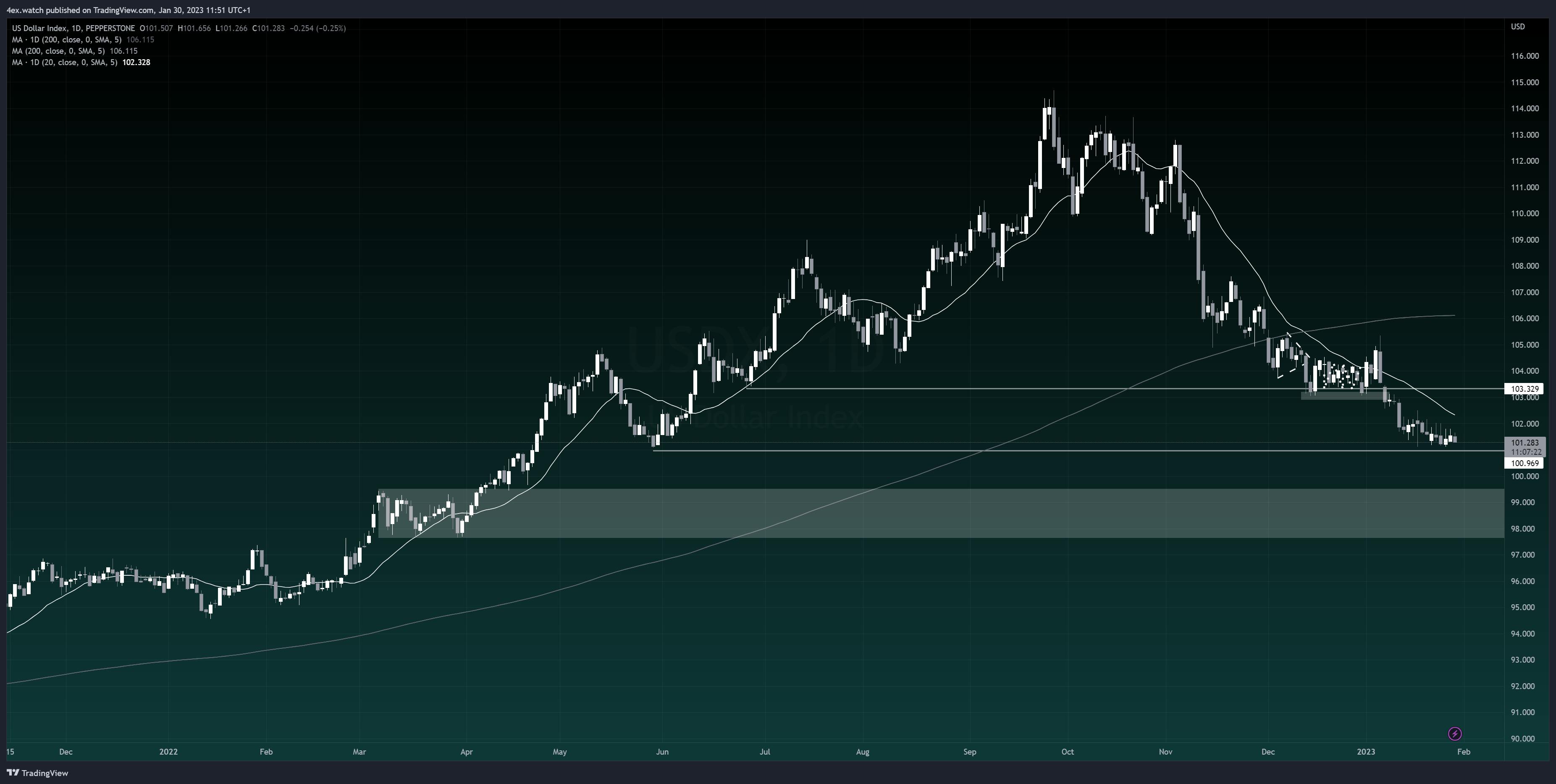

US DOLLAR INDEX

The US dollar sits tightly into previously highlighted support, and I’m not expecting much fireworks until Wednesday. Powell has a tough job of trying to make the first interest rate decision of 2023 sound even just a little bit hawkish, and the market is positioned to take him on heads-on. Room for disappointment or exaggerated hype from either side is a huge risk into this week. Whatever moves we get, the levels on the chart still matter.

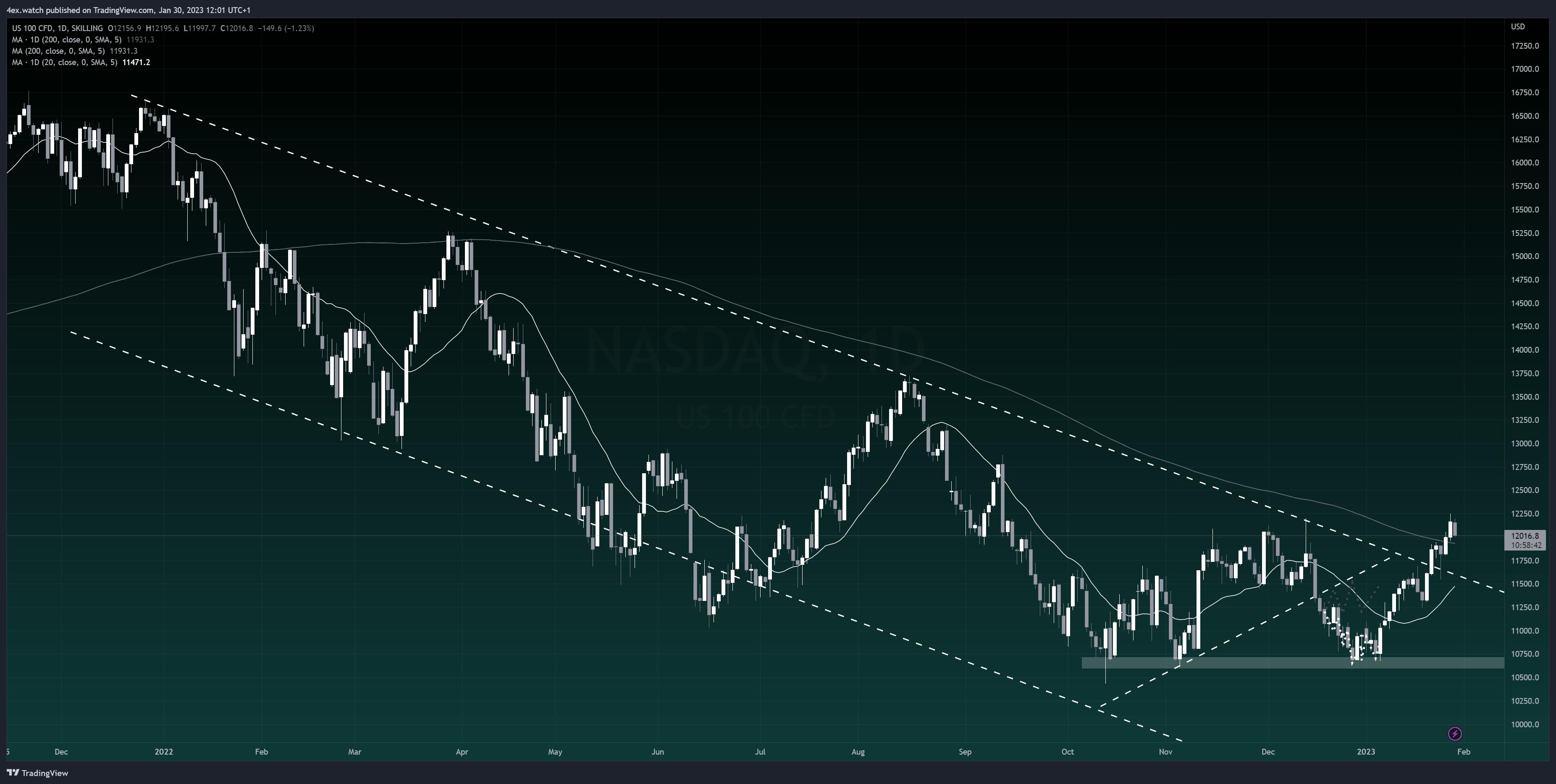

NASDAQ100

As I highlighted last week, the Nasdaq worked well as a catalyst for BTC, not only breaking out the downward channel but also overtaking significant resistance of the 200-day moving average.

We do however have a batch of earnings coming out, and with previous recession worries still weighing on corporate earnings, these set of earnings could put a dent in the recent bounce.

CLOSING COMMENTS

Whilst this week's macro data will provide some more guidance, right now it does feel like we are transitioning into a new market cycle. I don’t see this as a new explosive bull-run brewing just yet, but rather more a break of recent downtrends into a transitioning period of neither down nor up trend but rather a range-bound price action in pretty large ranges.

There isn’t enough liquidity in the overall global financial markets available right now for a full-on bull run to take off.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.