The USD keeps on taking hits, the crypto market shows signs of resilience as the rebound continues, and bears lose more and more control although we are seeing overbought signs across the board.

The US stock markets are still confined by larger downtrend resistances but we are starting to see a shift in the global outlook. Are we not even one month into 2023 and already having to redefine our views for the year? The Penalyst is here to tell if so.

Crypto and DeFi continue to be strong across the board of proprietary metrics that Penning AIF uses to determine broader market sentiment and development. However these signs of a healthy market are there, we see signs of peak greed and overbought metrics causing the need for some restraint. You don’t want to buy the top.

Adding to this slightly careful view is the fact that the USD is reaching support, several USD cross-FX pairs have failed to break out and the US stock markets have yet to break out of long-term downtrend channels.

Caution and buying potential dips at key levels seem to be our preferred way forward for now. And with that said, let's dive into the charts to look at where such levels lie.

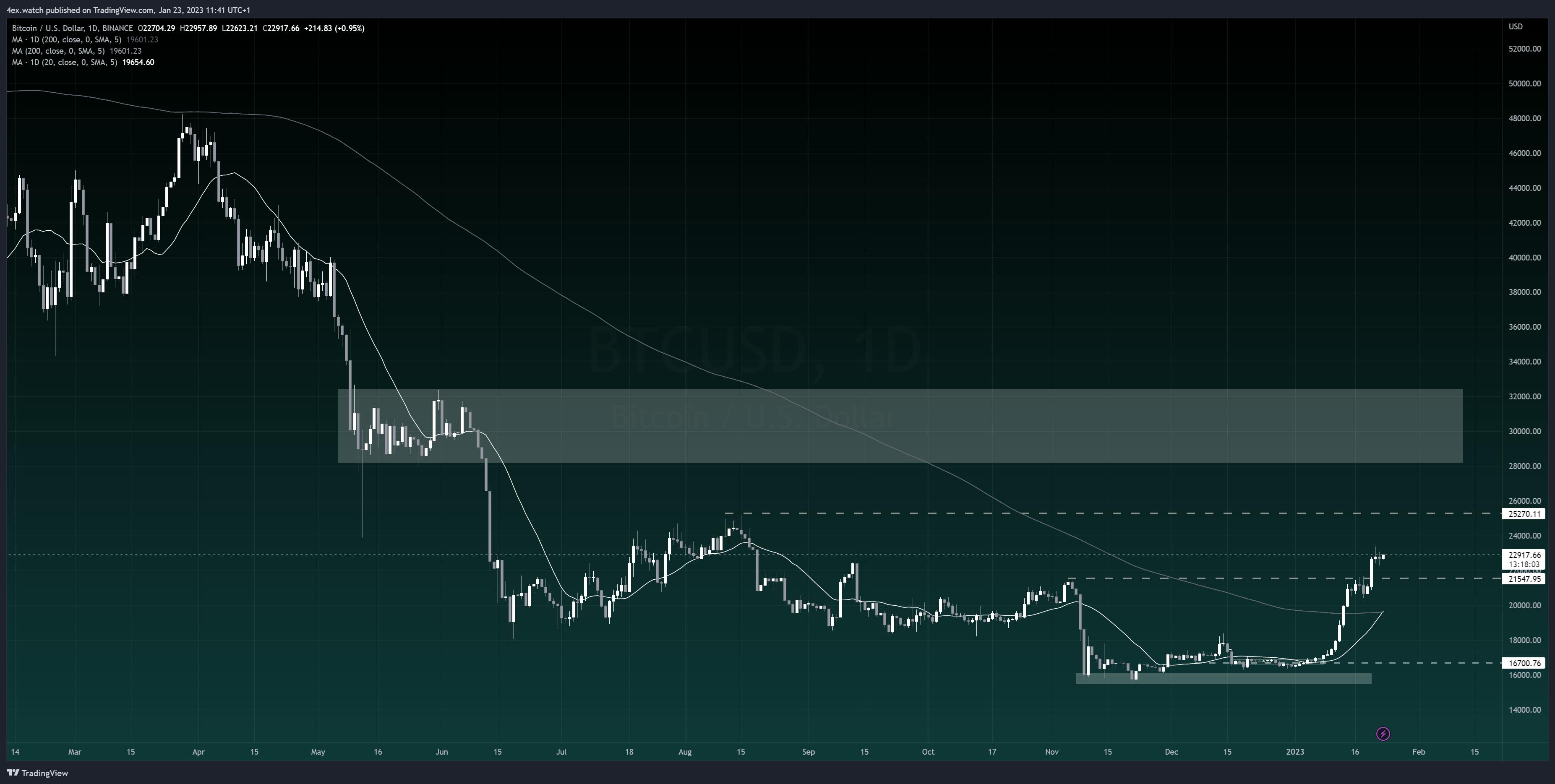

BITCOIN (BTCUSD)

BTC has managed to take out some very significant levels, and as sentiment improves with not only price data, but also positive news from events that initially hurt the market and investor optimism such as the FTX breakdown, the recent rebound, and potential trend shift is manifesting itself more and more.

The market is looking healthy but the true test will remain when we see a downturn and if a too large portion of the market is overleveraged into this rebound causing them to be squeezed out and triggering an unnecessarily violent pullback. Time will tell.

On the downside, buying dips into the 200-day moving average remains my preferred view for now, expecting it to hold.

To the upside, having taken out previously highlighted key resistance around 21 550 opens up the way for a test of 25 270 and an even higher consolidation zone around 30 000.

Structure wise the broader consolidation zone around 30 000 makes a lot of sense for BTC to reach and cool down around for a while.

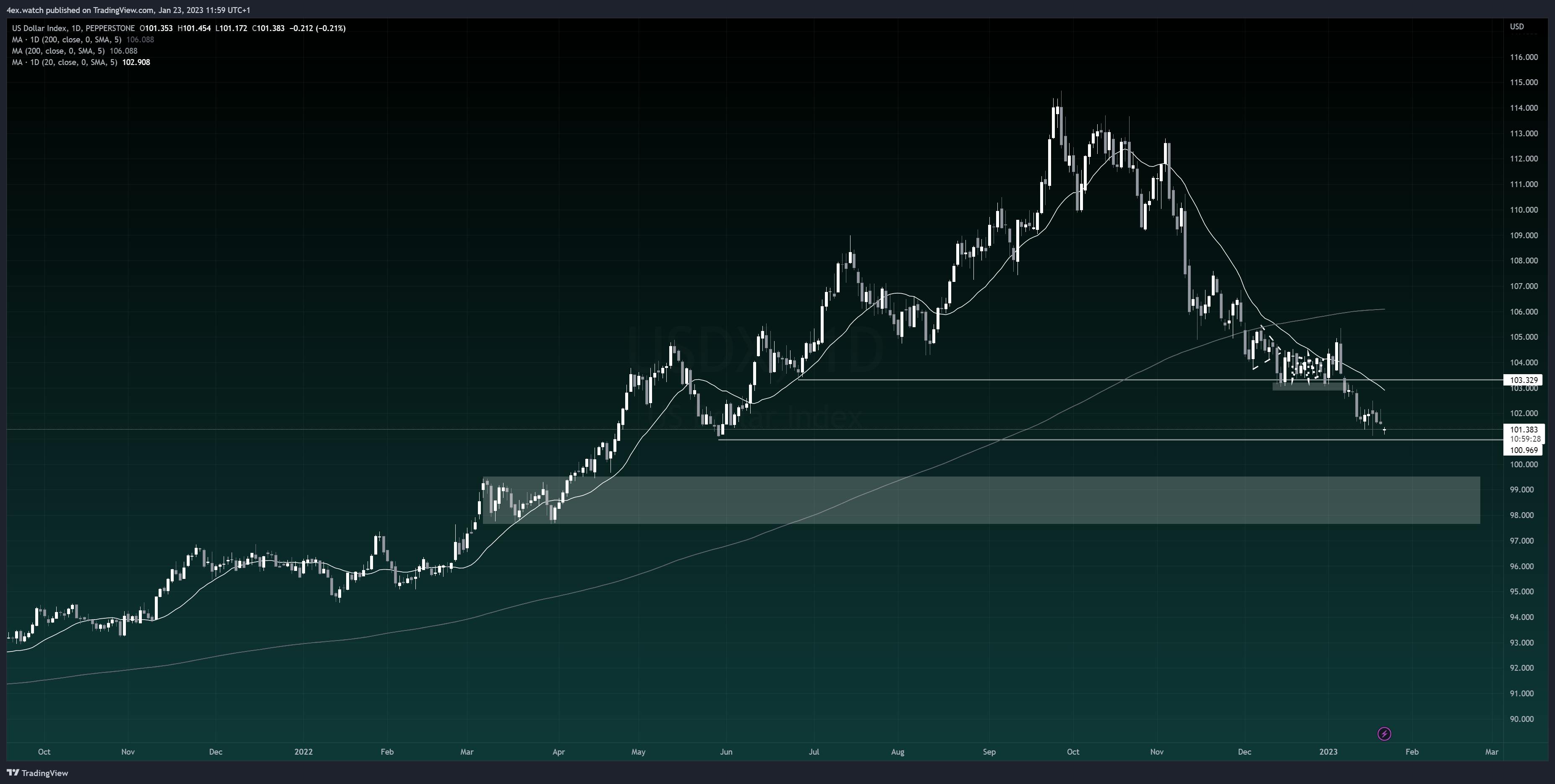

US DOLLAR INDEX

As mentioned the USD has reached its lower bound support sitting tightly to it. The most likely scenario would be a rebound toward the 200-day moving average before any move lower, however, a break of said support just below the 101 level could open up a move lower into highlighted consolidation zone around 99/98.

This would fit in line with BTC breaking higher into its consolidation zone too, so we have some nice Intermarket correlations here giving us two clearcut scenarios to the trade-off.

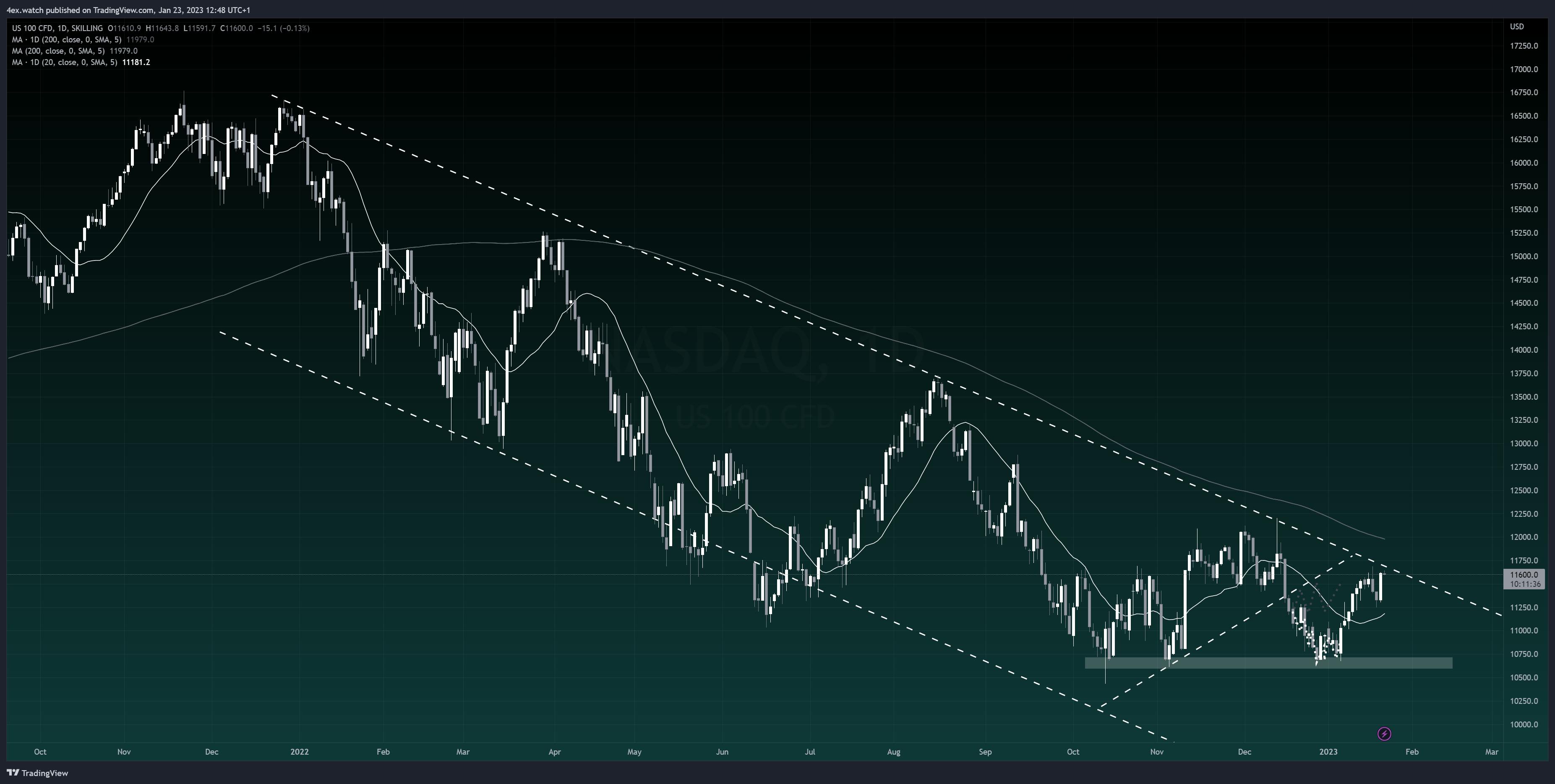

NASDAQ100

The NASDAQ could be the driving factor for other markets to piggyback off on this week.

On one hand, if we could get some strong readings next batch of earnings pushing the index out of its downtrend channel resistance, this could very well be quite a significant move with BTC following along the risk sentiment.

On the other hand, resistance is holding for now, bringing us in line with this week's preferred scenario of a pullback across markets giving some better buying levels for BTC.

CLOSING COMMENTS

We are seeing some great gains for our portfolio, in accordance with general market development and an abundance of value creation. We are however cautious about the highlighted risk of pullbacks and their effect on the markets. Additionally, any batch of bad economic data out of the US now is equivalent to bad news for the market. This is a shift from the “bad news is good news” paradigm that ruled up until recently, as worries have transferred more to recession focus rather than inflation.

No matter what the future holds, Penning AIF continues to operate under its two core values of DIVERSIFICATION and ADAPTATION keeping us nimble and quick to move along with whatever new market conditions emerge.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.