The crypto market takes a hit as the FTX dust starts to settle, with bearish indicators across the board with some very few exceptions. At the same time, the market turns to the December FOMC meeting and guidance from the FED on a potential pivot in monetary policy. The market is in a fragile state, and the catalyst for a move in either direction will likely come this week.

Last week I spoke briefly about the chances of a so-called Christmas rally. However, as we head into the mid of December, indicators have turned negative with the two main worry signs being that we saw global crypto volumes drop -42.1% week-on-week and additionally, the top 3 stablecoin market cap decreased together with overall volume indicating money is flowing out of the ecosystem into traditional fiat.

This week the market will look for the FED for any signs to propel risk assets higher or lower, not only looking for a slower pace in rate hikes with a 0.50% increase expected down from the previous 0.75% ones, but also the quarterly released dot plot that gives an idea if the different FED members view on the future rates. Any changes here, together with a shift in language will most likely move markets.

My worry is that the market is desperate for good news, and as such heading into this FOMC meeting with too high expectations. FED Chair Powell entered this year with widespread criticism of being too late on the ball and underestimating inflation. As such, I believe the market is forgetting that although a 0.25% lower rate hike is a slightly slower pace, it’s still a rate hike. Although the FEDs balance sheet is at its lowest since November 2021, having shaded $383 billion since then, it’s still $4.4 TRILLION higher than when we entered 2020. With that in mind, there is still a lot of tightening that can be done, and although we might see Powell make a slight pivot here to a slower hiking pace, I still think there is a large risk of him using language that indicates we are certainly not out of the woods yet, and that this slightly lower pace should not be viewed as “the beginning of the end” of this hiking cycle just yet. And I believe that such a narrative will not sit right with this market's expectations.

As such, the Penning AIF team is heading into this week with a short bias, ready to capitalize on further contraction across the crypto and DeFi space, while staying vigilant and ready to adapt to jumping on a temporary bull rally train if it decides to present itself.

BITCOIN (BTCUSD)

Looking at BTC, last week's rather large drop in volumes showed itself in the volatility too, with price mostly being sideways, and continuing to respect the recent lows whilst not really challenging topside resistance.

The 200h MA doesn’t give many indications rather than being in a slight uptrend with the price hovering around it.

On the technical side, we still need to see BTC set a lower low or a higher high to really give an indication of the near-term direction. Until then, sideways price action is expected.

But given this week's heavy macro risk, close bound technical should not be considered very relevant, and any future trends will most likely be set this week by the macro basis.

US DOLLAR INDEX

The US dollar index is currently wedging, what is considered an explosive breakout pattern when broken. This falls in line with the current macro risk into this week, with the dollar not wanting to make any significant moves last week, and now putting in higher lows with lower highs, waiting for the catalyst to generate a larger move. I expect price action to be rather volatile and whiplash in the US dollar over the first couple of hours heading into but mostly after the FOMC decision.

NASDAQ100

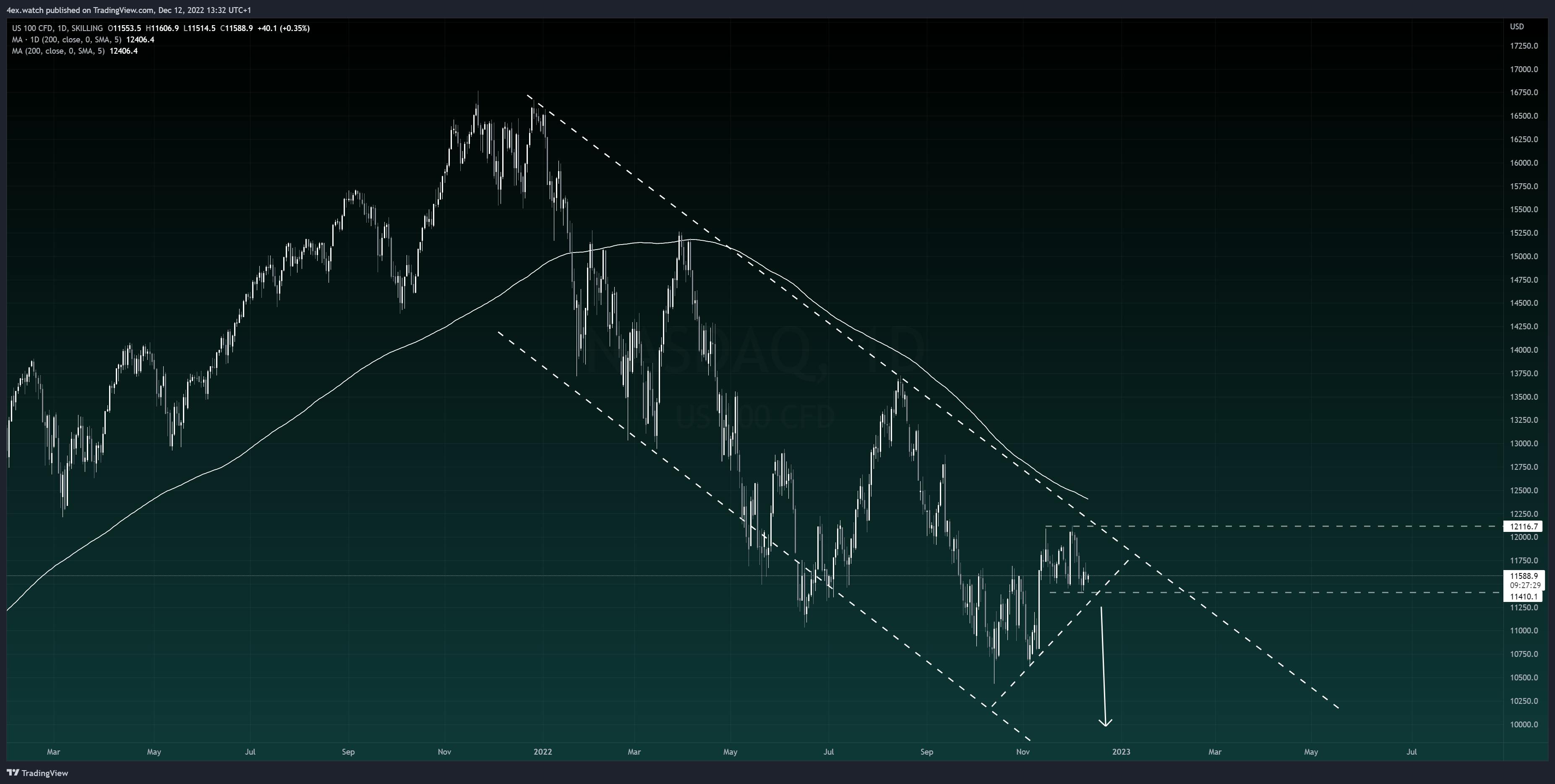

The NASDAQ highlights just this risk I’m talking about, with the daily chart showing a perfect short setup if the risk mood turns sour on Powell not being dovish enough.

We are inside the descending channel that has characterized this current bear market, with price wedging inside the channel, hinting at a momentum-driven breakdown.

On the other hand, a break outside of the channel to the upside would hint at a possible trend shift, but for that to be the case I do believe the FED needs to deliver some very clear guidance in this slower pace actually being the beginning of the end for this hiking cycle. And as described earlier, I don’t see the odds in favor of such a scenario. With that said, it’s not completely off the table.

So to conclude, the crypto and DeFi space are in a delicate state, and this week will most likely paint the picture of what to expect for the space heading into 2023. Trying to predict large macro events like these is really a coinflip, and as such, I personally prefer taking a reactive approach rather than a proactive one.

At Penning AIF, we have the mandate to short the markets too, and as such equal yield, and opportunity can be achieved in both contracting and expanding market cycles.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.